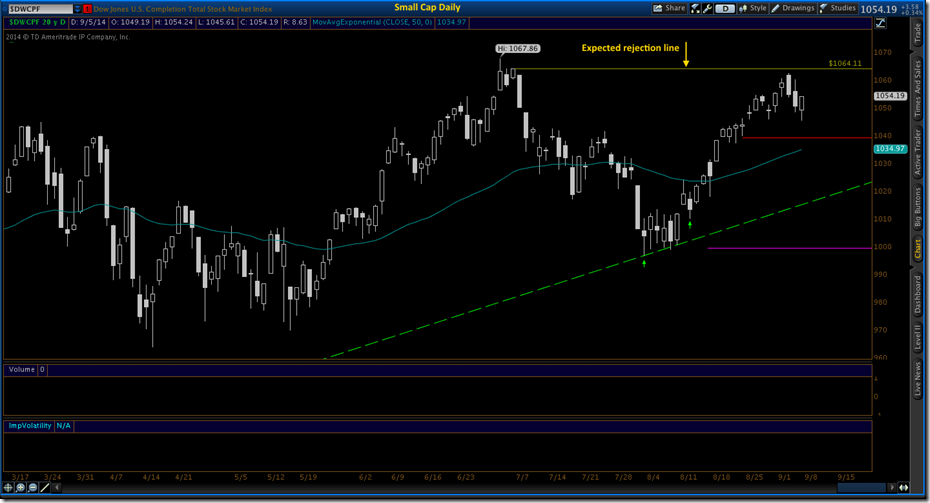

The Small Cap made a very nice recovery over the last 15 trading days, but it did exactly what I thought it would do and that is pause at the last high. $1064 is the line. We need to see price go through this level in a timely manner. The longer it lingers the greater the odds that we will reverse hard. We are due a little pull back or consolidation because it has been a straight up climb since bouncing off the green support line on the chart. I would like to see us create a higher pivot low above the CBL and 50 day moving average and if you look at the closing action from last Friday, that could happen early next week.

Let’s peek at the minute chart from last Friday.

At the opening Friday we kind of slid out of the gate downward and then bounced up a little only to reverse lower. But look what happened after 11am. Price marched uphill into the close and never faltered. So I think come Monday, unless news driven, we should be looking at a higher open.

So currently we are safe with the Small Cap and no warnings fired.

I’m still not convinced the International is out of trouble yet for a few reason. You could argue that the current reversal we have going on is nothing but a bear flag built off the last downtrend. 10 to 15 trading days is the normal average when it finally breaks one way or the other, so next week we should know. Thursday and Friday, price sank to the point that warning one was fired for a sell on the daily chart. The green trend line was adjusted this week to represent the last major pivot low. The CBL is still safe at $66.24. The International did not climb hard into the closing like the Small Cap or the S&P500, but it did climb back to even for the day.

Conclusion: International is back on the watch closely list next week.

Bonds have once again fired a warning by breaking below the CBL. Price is also just above the 50 day moving average by 4 cents. A little lower and warning two will be fired. But look backwards on this chart, can you see 4 times in the recent past that price hovered around the 50 day moving average and then went back up? So I do not believe Bonds are in trouble here unless that trend line is broken and we get below the 10 monthly moving average.

Conclusion: Bonds are back on the watch list next week.

No chart needed for the S&P 500 because it is just pretty right now with no warnings. Yes it is consolidating, but nothing to worry about at this point in time.

Let’s go September, last year was an ass kicker gain, so get busy.

No comments:

Post a Comment