Hard to believe that another year has past by but here we are looking at the close of 2014. It has been a rough year in the markets for me and a few others out there. If we had all used the monthly moves, we would likely have a 8 – 12% gain this year depending on the mix you choose. But as long as we do not have another pull back the last 5 or 6 trading days of the year, I will end up between 4 – 6% gain. I made money. That’s it. I made money. So I’m happy.

I really do not have anything new to say about the C-fund and F-funds, so I will post their charts and you can just look at where we are. The S-fund and I-fund are still the topic, so let me get going.

F-fund and C-fund respectively.

The International Index or I-fund did not participate completely with that 3 day snap back last week. On top of that, the structure on the daily chart is still downhill. Add the fact that the monthly says stay out and there is nothing here to like. If you would have bailed out of the I-fund per the monthly chart on 10/1/14 and divided it equally into the C and S-funds, your gain would be 6.9% in the C and 7.5% in the S. That’s a 7.2% gain versus leaving it in the I-fund hoping and wishing it is going to rebound. Let me salt your wound just a bit more. Since 9/30/14 when the monthly said get out of the I-fund, you have missed the 7.2% gain and lost another 2.2% in the I-fund. Ouch. A 9.4% flip.

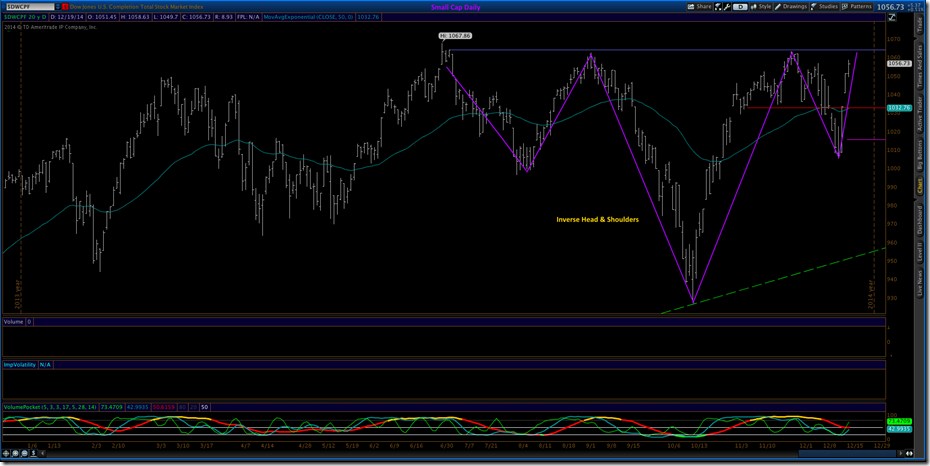

This has been a long time brewing and I actually believed all along that this was going to turn into a disaster and the markets were going to collapse because the Small Cap could not get through all time highs. The more times that high is tested and fails, the more likely it will fail. Ok, so what are the purple lines that I drew on the chart above? They form what we call an Inverse Head & Shoulder pattern. If we get a breakout soon to the upside with a higher than average volume, we may be on are way to finally breaking out. What is the measured move? That is the distance to the breakout zone to the top of the head. That number is a 137 point move to the upside which would take us to 1201. That would translate to a 12.9% gain. So this is worth watching.

No pattern is a sure thing and with what little bit I know, this just puts you in the driver seat to take a chance on it breaking the way you think. If it is wrong, you keep a tight stop underneath and bailout. That is how it is played in stocks. As far as our TSP goes, it is just good to know information. We still should make our moves based on monthly calls emotion free.

Merry Christmas to all and may your next year be your happiest.

No comments:

Post a Comment