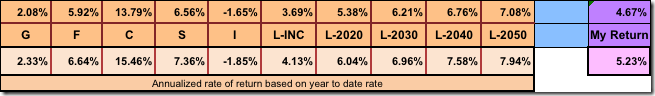

S&P 500 up another 1.16% again this week and was the winner again. I managed to beat the L-funds this week pulling in a gain of .94% for my 50-50 setup. I’m very happy with that. This coming week is a holiday week and a short week for the market. On top of that, it is the end of month for November on Friday. The market is open Friday but only from 9:30am to 1pm. As of right this minute in time, I see no changes coming for the monthly moves unless we have some drama this week. Below I will show you the current status of the daily charts.

The S&P 500 above closed at a new all time Friday and is safe. Just along for the ride here.

Small Cap had a fairly good week this week but only because of Friday’s move. Monday through Thursday it grinded sideways to down side all week. I drew 2 blue lines on the chart above and I think they are very important for the Small Cap to take out. The first is the most recent closing high from September 2, 2014. The second one is from July 3, 2014. Current price is close and those levels are $1059 and $1064.11 respectively. I have long said that the Small Cap is holding the overall market back and taking out those closing highs might put us on and end of year run to the up side. Failure to do so, could bring another pullback. We should be watching this index closely.

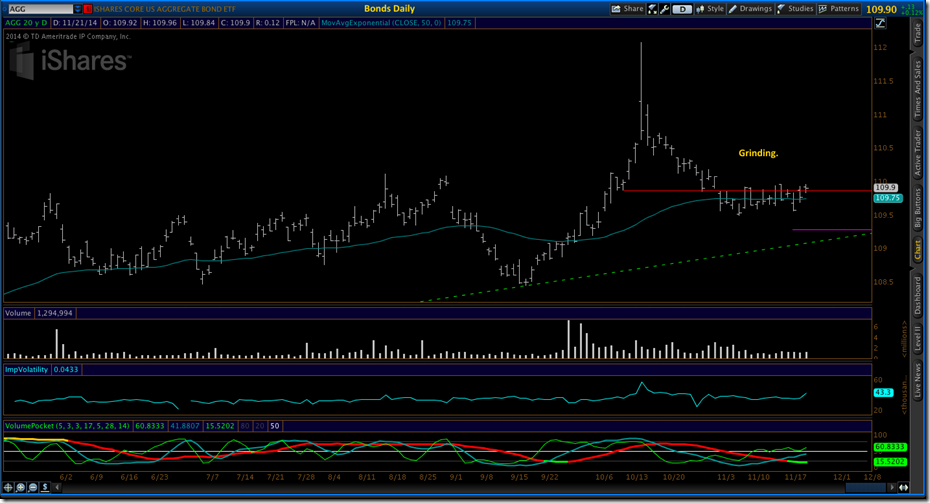

Bonds have been grinding safely sideways for 3 weeks. I’ll be curious which way this will break. Watching.

The International index has also been grinding sideways for 3 weeks. What is different about this grind versus Bonds is the International is in a Bear Flag. What happens 75% of the time when the Bear flag breaks? Price goes down hill. With that said, current price did break above the green CBL line and hold for 3 weeks. Price also broke above the 50 day moving average, but it is waffling back and forth on that 50. Not to impressive to me. That downtrend line that is dotted red is about to be broken which would complete the daily buy signal for bonds. What I have a problem with is that it is break with sideways duration, not a breakout surge to the upside. Once again, not impressed. See that purple line above price? Well based on that one line, it is not a buy using the monthly method. So maybe this is an early buy sign for the I-fund. I guess you could argue it is worth a shot. I’m saying be carful. I would really like to see price follow the S&P 500 and Small Cap and that is not currently happening.

I’m still staying out of the I-fund.

Have a great weekend.

No comments:

Post a Comment