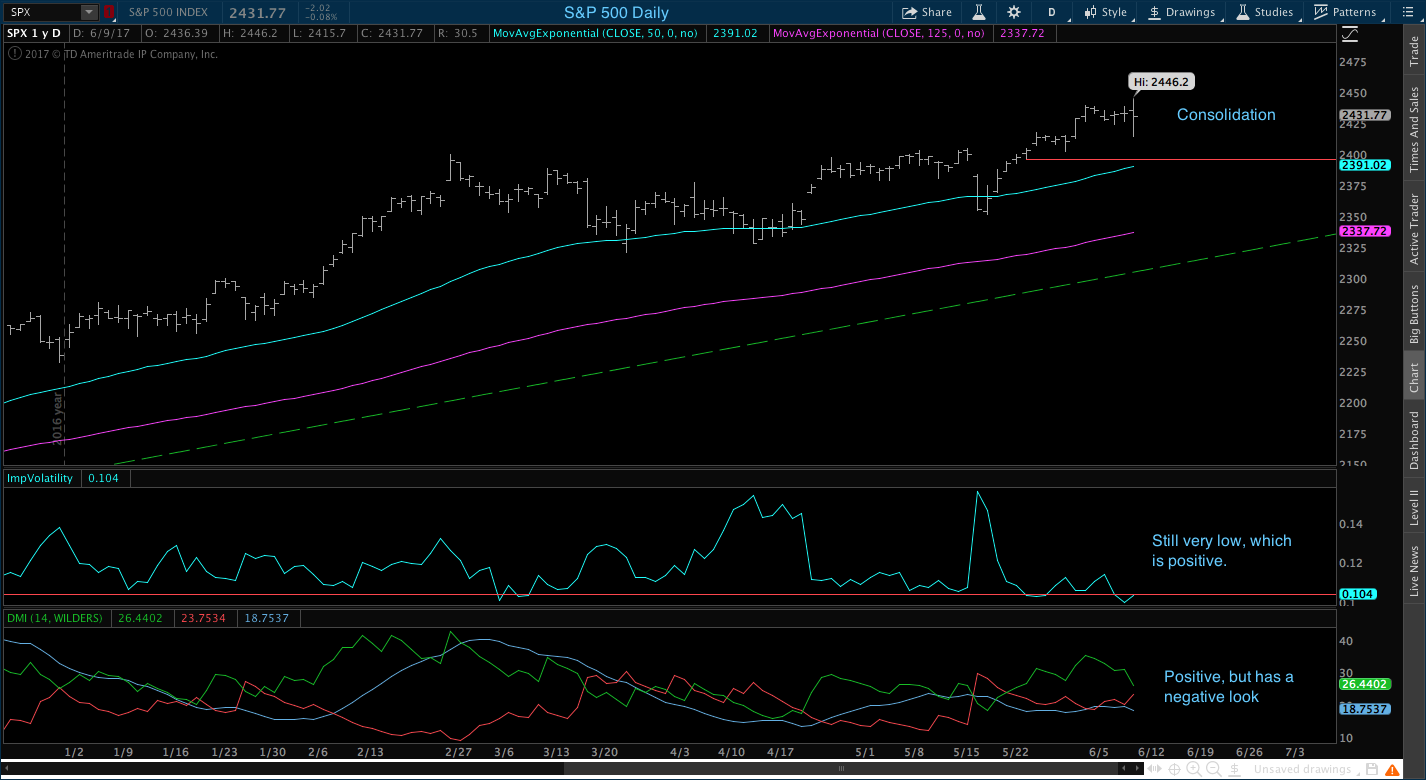

The S&P 500 this past week consolidated sideways with no significant movement. Volatility is low which is a good sign for the near future. The DMI appears to be turning negative and could flip negative next week. Overall the S&P 500 daily structure looks good.

The Small Cap daily looks like it is perched to go higher. I would say that it is about time since it has been consolidating sideways for almost a month. The DMI is still positive but it is not showing a strong trend yet. The red line needs to get below the blue line to show a firm strong uptrend.

The International was likely due a pause, pull back, or consolation. Last week we got are first sign in a long time that it is going to happen. DMI is still very strong, so all we can do is just watch this develop.

Bonds also did the fade all week lond. Volatility is very low and is a positive for the future. DMI is still positive. Nothing to do here but watch but I will say in order for structure to remain positive, Bonds need to rise higher next week.

Conclusion: It was a very boring almost non-event week last week. Yes is was a down week but overall if your were spread out like I am in 4 different index, it was a very minor pullback. I expect that the Small Cap will lead us higher next week beased on the charts above, but I’m not looking for anything major to the upside. It is summer time as far as I’m concerned and things just get wierd this time of year. I never know what to expect out of stocks.

No comments:

Post a Comment