Old Dix TSP Blog

I'm not a professional trader but when I do trade, I trend trade.

Sunday, December 31, 2017

Olddix TSP blog has moved

Friday, December 29, 2017

TSP end of week, month, and year for 2017

Thursday, December 28, 2017

Friday will be the last day of 2017.

Wow, where did 2017 go? I have to say that it has been a year that I will not forget personally because of all the life changes I had the last 12 months. Everything in life happens for a reason and I truly believe I am a better person today.

As far as the TSP goes, you and I had an incredible year if you followed my moves. It's not as much about the money as it is about the method. I promote a very calm and logical way to invest while young, while growing or aging, and while retired. If you take the time to learn my methods and listen to what I say, you will sleep and live a comfortable life when you retire.

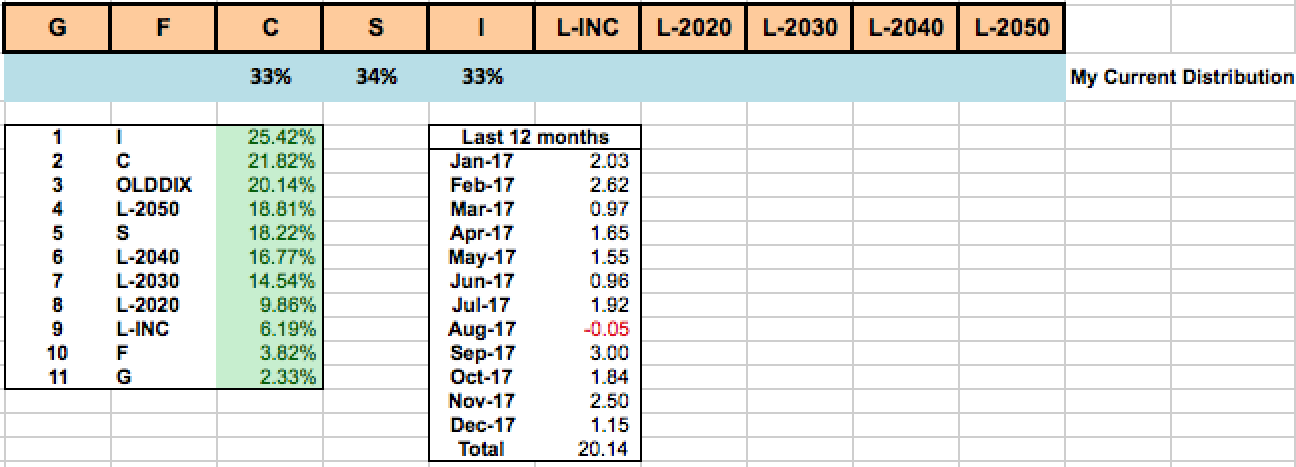

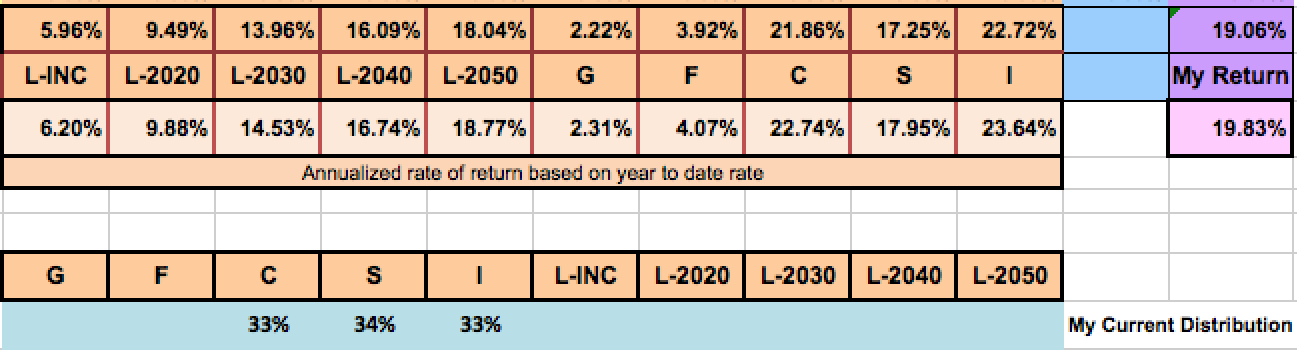

For the first time in very long time, I am going to beat the L-2050 by over a 1.3%. That is awesome. I also blew out my personal PIP goal for 2017. My goal is a 7% gain, never have a negative PIP for any 12 month period, and if I do, never have a double digit loss. I will make close to 21% this year. With the size of my account, the growth of my account exceeded the income of more than 94% of people living in the United States. That is even more than I can comprehend.

In 2018, I am going to convert my blog into a pay site for a few reasons. Are the 109 followers that I have on Facebook real? Do I have followers that truly want and need what I provide? If I am writing this blog and is it being read by no one but myself and my family, then I can end it. The time I spend putting all the charts together and writing the blog can be spent doing something else. I accomplished my goal in finding a method to run my TSP account in retirement that cost me nothing and will let me sleep.

But, if I have 5 people out there in TSP land that actually want and need what I do and are willing to pay $10 a month for it, I will continue. If I only get 4 or less, I'll refund the money to the 4 and close shop.

So, the ball is in your court. Is Olddix TSP worth it?

Either way, it's been an awesome ride and I've learned a lot.

Now, let's get busy working on everything for 2018.

Monday, December 25, 2017

Saturday, December 23, 2017

TSP daily charts as of 12/23/17

Friday, December 22, 2017

Sunday, December 17, 2017

I am back, and here are the closing numbers and charts.

Friday, December 8, 2017

TSP closing numbers as of 12/8/17

Thursday, December 7, 2017

TSP 2018 contribution reminder

Credit to my son for forwarding this to me yesterday. Even though we have spoken about this, it is time to make your adjustment.

TSP Contribution Limits for 2018

For Calendar Year 2018, employees will receive 27 pay checks instead of 26. Therefore instead of contributing $712.00 as previously advised for the maximum amount for TSP, your bi-weekly contribution should be $686.00. Please make the appropriate change by the deadline below.

To make changes to your Thrift Savings Plan (TSP) Traditional or Roth Contributions, or to elect or continue TSP Catch-up Contributions, please log into My Employee Personal Page at www.nfc.usda.gov/epps. Your changes must be submitted no later than December 9, 2017, with an effective date of December 10, 2017, pay period 25, to ensure it is effective the first pay period in 2018.

The combined annual calendar year 2018 TSP Contribution limit for Traditional (pre-tax) and Roth (after-tax) is $18,500. If you want to contribute the maximum amount and receive the Matching Contributions, your per pay period amount is $686.00 . You may also choose to contribute a percentage, up to the maximum amount. If you are covered by FERS and you reach the maximum amount allowed prior to the end of the calendar year, you will not receive the Matching Contributions for the remaining pay periods. You will still receive the Agency Automatic 1% Contribution. It’s best to have equal contributions for each pay period.

In addition to the $18,500, you may also participate in TSP Catch-up if you will be age 50 or older in 2018. The annual catch-up contribution limit is $6,000, your pay period amount is $231.00.

Note: If you elected Catch-up Contributions in 2017 and would like to continue the contributions into 2018, you MUST make a new election.

Wednesday, December 6, 2017

Time for a little vacation.

Tuesday, December 5, 2017

I-fund sell warning

Saturday, December 2, 2017

Retirement transition from July 1st to November 26th

The Executive Director of the FRTIB has the authority to establish parameters regarding this new ability to take multiple withdrawals, and the law gives the FRTIB up to two years to make the regulatory and operational changes necessary to enact these changes.

Friday, December 1, 2017

Thursday, November 30, 2017

TSP Novemeber closing numbers and monthly moves for December