Hi TSP’ers! That was a wonderful vacation. It was our first cruise and other than a little cold leaving the harbor that first night, it was close to perfect. We really had a good time traveling with friends, exploring, excursions, shows, food, and drink. We are already searching for our next destination. I think I am going to love this retirement thing.

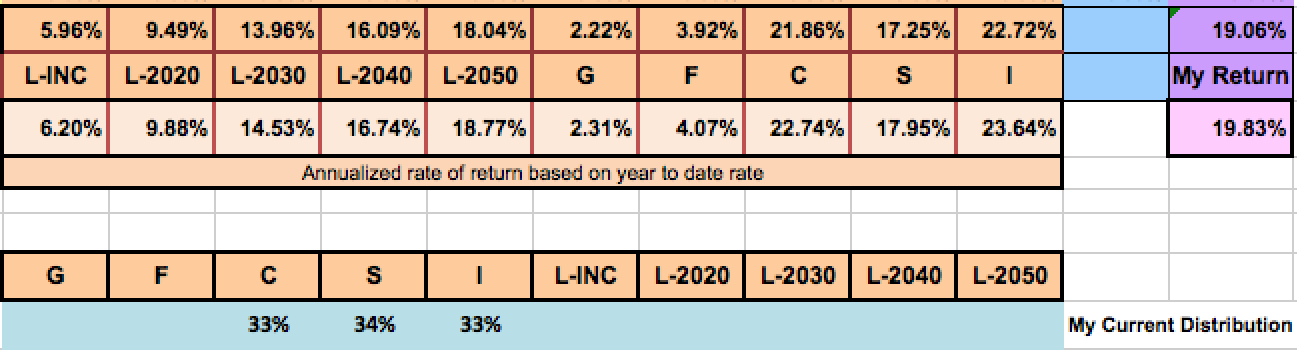

The Stock market had a very good week while I was gone and brought us all back into the green. We need strong run for the rest of the month to match last years December returns, but no matter what happens, I think we will all end 2017 positive and leave us hoping for more in 2018. Now for our closing numbers for the week and charts.

The S&P 500 last week was the leader. With a near 1% gain for the week and a almost picture perfect price structure, what else could we want? I’ll tell you. All time highs and we also got that. The DMI and volatility are both positive. There is nothing you can find on this daily chart that is negative.

The Small Cap had an ok week, but it was a bit sloppy. The larger the daily bars, or longer bars I should say, the more volatility there is for that day. The more of these you get back to back, the scary the market can be. It can also be very hard to see direction. I pointed out some of those days on the chart above. The last two had some big swings. Also what concerns me is if you look about 10 days back, that nice up swing we had came to an end. This could be a temporary pause or consolidation, but I was really expecting a longer surge up. To me, price needs to continue uphill from here and if by chance we fall below the red CBL, it could hurt.

The International showed a small gain this week but in reality nothing has been accomplished. Wednesday we bounced off $70.48ish and returned to lower prices. See that little dip below the CBL? That is the last pivot low at $69.18 and we need to see price reverse to higher prices before that point breached. We also need to see the overhead resistance at $70.79 brorken through. If we see all those things come true, it will give us the confidence to know that this uptrend structure will continue.

Bonds also ended the week positive, but like the International, nothing has been accomplished. Price has been trapped in a channel since November 7th and we will see next week if we break out the top or if we get more of the same and down we go to the bottom of the channel. Weekly and Monthly, bonds are still a sell.

Conclusion: We have 9 more trading left for 2017. It is hard to believe that another year is in the books, but it’s gone. 2017 is going to go down as one of our best years for gains, but what will 2018 bring? First no one knows the answer for that question, so we have a mechanical none emotional solution to help us navigate the unknown. As for the now, other than the S&P 500, 3 out of 4 of our primary indexes are grinding. Grinding sideways sometimes is a sign that something is going to break in a direction very soon. In most ever case, the current trend is the direction that a break will go. My only fear here is that this run uphill has been running so long that a reversal lower is almost expected. I will not exit my position on a theory but will wait once again for a proper signal to make a logical move. Every single time I have tried to out smart my monthly moves, I have failed. So bring on 2018 good or bad, let’s make the most of the moves that are required.

No comments:

Post a Comment