Over all a pretty quiet week on the stock market. It is almost putting me to sleep. Don’t take that as a complaint because I will take the no drama summer where prices continue to rise and makes our TSP accounts grow. We have 6 more trading for July 2017 and I do not think there is any chance we repeat with a 3.31% gain as in 2016. So far this month, I am up 1.96% and that makes me incredibly happy. To have a gain in any summer month is awesome.

I retired from the FAA officially on June 30, 2017. I got my letter to inform me that the Office of Personnel Management (OPM) has gotten my retirement package from the FAA and it has been certified correct. This as of 7/17/17. As of 7/22/2017 I can still access Employee Express but I assume that will change soon and OPM will give me a new PIN and website address to access my monthly income soon. I am really looking forward to my pay cut, (humor). Since I decided not to withdraw no money from my TSP, I will be curious if I can afford to live off the annuity alone. Those that young with many years of work in front of them, do not take these litte details serious, but they should.

Chatter !! I am beginning to see a fair amount of chatter about the President’s proposed cuts on FERS & CERS emplyoees. Not only does it concern the peeps still working, but this also should concern those that are retired. So don’t just let this news float by like it will not affect you, because working or retired it will.

The White House budget proposal suggested eliminating Cost of Living Adjustments (COLAs) for current and future federal retirees under the Federal Employees Retirement System (FERS). For retired federal employees under the Civil Service Retirement System (CSRS), COLAs would be reduced by 0.5%.

Now I just retired and that will not affect me for quite a awhile. I will not be getting raises )COLA) because I chose to retire under the Vision 100, which means I get 1.7% for each year I worked with no raises until I reach 62 years of age. But, there is a lot or retired Government Employees out there, FAA, Police, Fire, and others that this will affect.

The amount FERS employees contribute to their annuities would increase by 1% each year for six years at which point the government and employee contributions would be equal. The method for computing retirement benefits would go to a high-3 to a high-5 system. The supplement for FERS employees who retire before they reach Social Security eligibility at 62 would also be eliminated.

Going to the high 5 is just another way for the Government to save money and cut your retire pay. It’s you base pay high 5, not your total earned in case you youngsters out do not know. My suggestion today is watch what your Unions are doing and if they want you to call your representatives, you should. Now to the charts.

The volatility is starting to reach record lows. You can follow the raw volatility by tracking the VIX or you can click THIS and it will show you my chart. Being inside the upper and lower red lines is normal and getting outside those lines is extreme high or low. The S&P 500 is on cruise control and the other demerit would be that the DMI still needs work to be a strong uptrend indicator. Green and Blue must be on top or Red to show strength in trend.

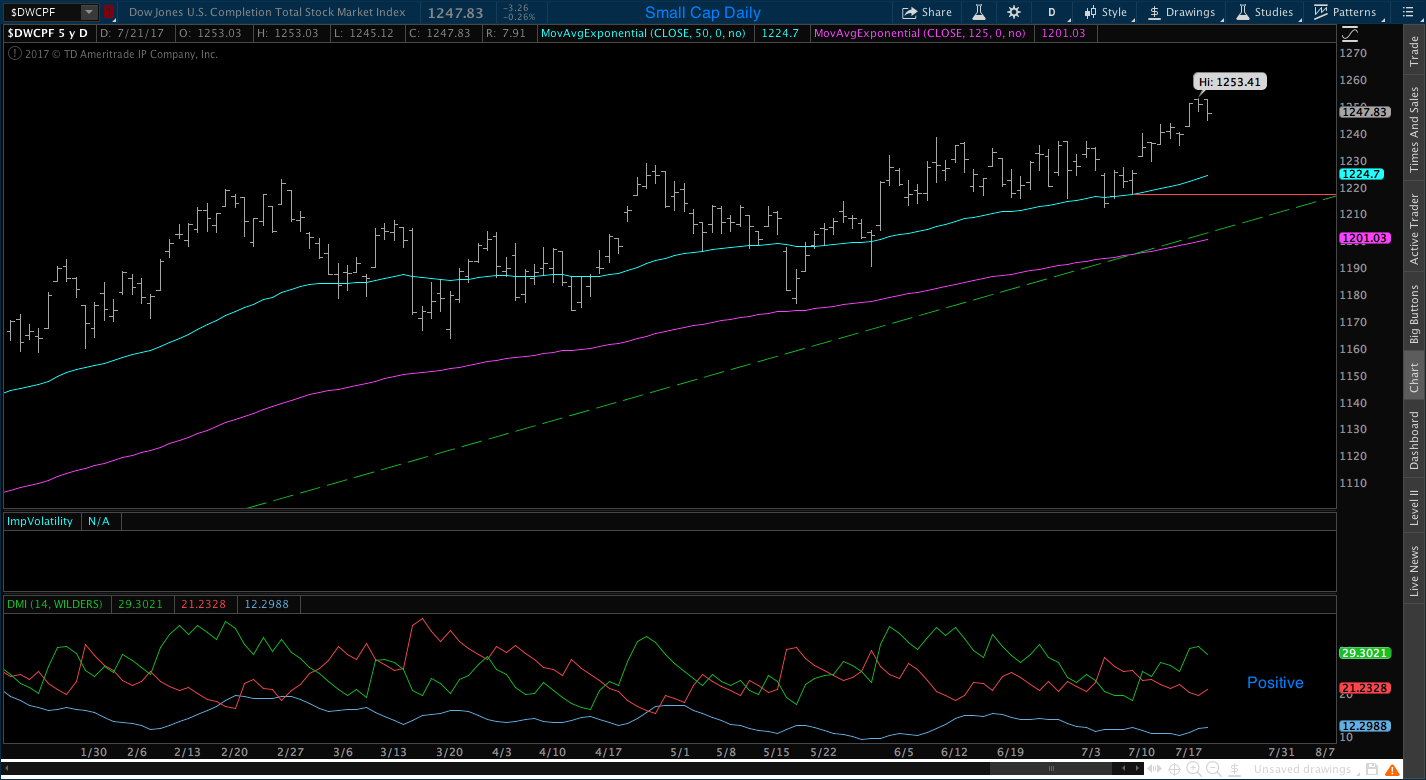

The Small Cap daily chart is also on cruise control. The DMI still needs a little work but like the S&P, it is still positive.

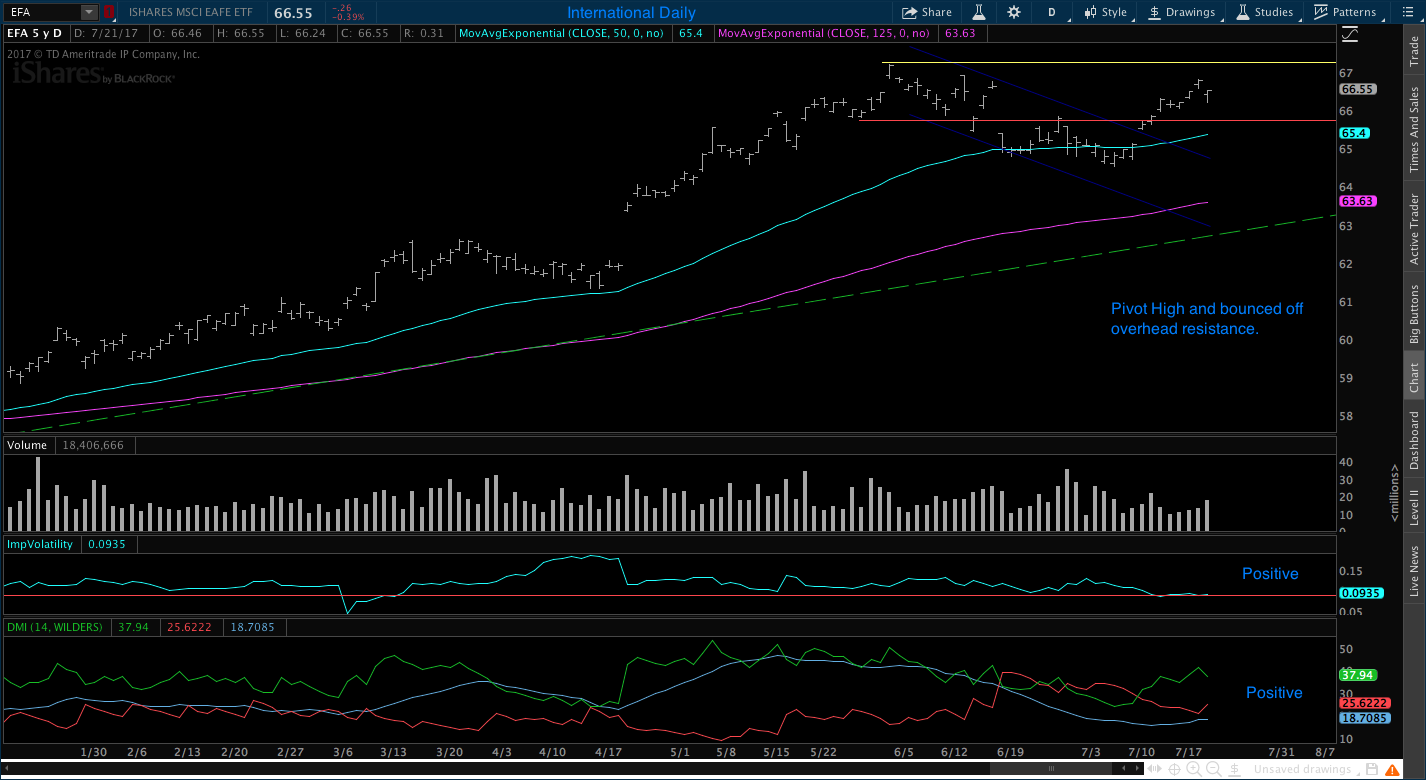

The International Daily made a nice bull flag break out last week. I gave you an expect run to the high side to watch for. It doesn’t mean we go straight up or straight to that point and then stop. We should have a what looks like steps being built to that point. Friday we pulled back after 7 days without a major negative day. Friday we also created a pivot high and we should see a couple more days of lower prices. Hopefully we go no lower than the red line CBL and then continue to march higher. I am a little concerned that the pull back happened almost at the overhead resistance level that I drew in yellow on the chart. Price does need to bust through that level in order for the bull flag breakout not to fail. Everything else on the chart looks good.

Bonds have made a surprising reversal over the last 2 weeks. Even the DMI looks like it going to confirm a strong uptrend indicator by next week. We have a new sort term uptrend line green drawn. Even the DMI is positive. It will be interesting to see what happens as price approaches the resistance level that is drawn in yellow on the chart. Last week, Bonds fires and confirmed a buy signal. Last week post, I mistakenly showed the weekly as a sell. It never fired a sell signal weekly.

Conclusion: Last week the S%P 500 and Small Cap hit all time highs. Volatility is also at all time lows. A smart person at this point of the summer time might just pull all their money out and put into the G-fund. The odds are with all time high prices and volatility all lows, that a reversal is close. When things get to easy, a reversal might be close. I will continue to follow the monthly moves and hope that if and when that pull back happens, it doesn’t take all of my last 12 months worth of gains, which are over 21%.

No comments:

Post a Comment