This week in retirement I got my first interim check. Not to shocking because I did a little math in the beginning and had a pretty good idea of what that amount might look like. The only deduction of pay that I can see today is Federal. The way I understand it, no state taxes with be withheld from the interim checks. I assume my Health Insurance is being paid, but I have no physical proof yet. I still have access to Employee Express. I now have temporary access to the OPM website to get access to pay info because they mailed me a temporary password. So in one month the transition from Employee Express to OPM CSA page is almost complete. Annual Leave payout check has still not been received. I am officially 5 weeks into retirement.

I need to say this one more time for all my peeps that are already retired or getting ready to retire. You can’t run from stocks. If you run it properly, you will be ok. But you can’t run from stocks. Read please and make sure you click to page 11.

The S&P 500 had a very unspectacular week. Since hitting highs a week ago, price seems to consolidating and considering it’s next move. Volatility is still low, which is a good thing. The DMI is sending mixed signals and considering we are in the middle of Summer doldrums, it seems normal to me. We just watch and wait and see what happens here.

The Small Cap is getting more and more concerning as the trading days tick away. Since reaching it’s high, we had 8 trading days pulling back off those highs at a pretty sharp angle. I could argure that this is a bull flag, but it’s off a pretty weak uptrend angle. This week we got are first sell warning because price fell below the CBL. Price is closing in on the 50 day moving average which a close below that would be sell warning 2. Next week the closing number we really need to watch is $1218. A close below that would a daily sell and would also say a major pull back could be here. DMI here is negative but has been pretty sloppy for weeks.

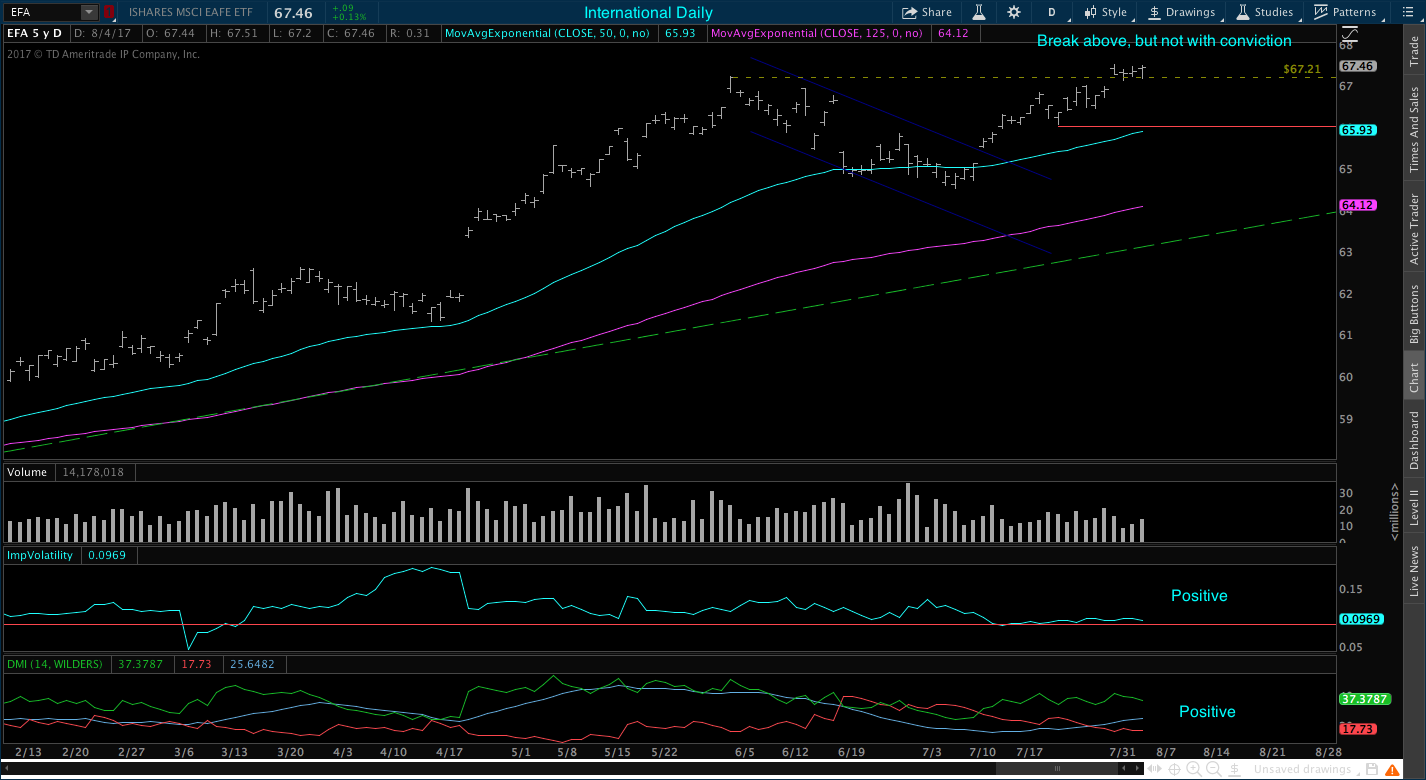

The International index accomplished it’s mission on breaking out above the overhead resistance of $67.21. What it did after that was nothing. Price just laid flat the rest of the week and wasn’t a comforting bull move breakout. I think next week we will find out if this was a true breakout. Holding at or above $67.21 is key. All the underlying ingridients are there to support it. Volatility is positive and the DMI has now flipped to a strong uptrend indicator. We have green above red and we have blue above red. Both together is an indication this uptrend should run uphill for awhile.

Bonds to me have been a mess and hard to invest in. On paper it seems to have a trend uphill, but too look at the picture above, we are going sideways. If you would have put all your money into bonds December 31, 2016 and left it there until today, you would have a 2.92% gain. That’s not bad and is above the G at 1.36%. DMI is mixed. Volatility is low and there is nothing saying not to be invested. At the end of July 2017, the monthly signal was to buy again. Why did I say again? May was a buy signal, June was a sell, and now July is a buy. Monthly signals are not suppose to work that way. So if at the end of August, Bonds are still a buy. I will roll some money in that direction.

Conclusion: I hope some of the retired peeps and some of the soon to be retired peeps read that short Kiplinger article I linked at the beginning of this blog. Our C, S, and I funds that trade inside the TSP are some of the most tame non-egressive mutual funds in the world. On top of that, they are cheap to run with expensive that are ridicoulosly low. Do not think of our Stock funds as being in stocks. Think of them as being invested in Mutual Funds. No one stock will ever kill your portfolio. Our C-fund has over 500 stocks invested inside. The Small Cap has somewhere bettwen 4500-5000 stocks inside. So watch the trends and watch the percentages. The worst thing you can do is watch the dollar figures inside your account. Why? It’s great when things are good, but the second you have a week or two of bad returns, your gut will tell you jerk your money out. But, if at the end of each month you have a positive return percentage wise, the cash amount in your account will reflect that. Watch you PIP and watch your percentage return monthly.

Example: If I told you in one month you took a 1% loss in your account, would you move your money to safety? If I told you in one month you had a $10,000 loss, would you move your money? Believe me as you age and your account grows, this is going to happen. 1% of 1 million is a $10,000 loss.

Example 2: If you had a gain of 11.87% since the January 1, 2017 and had a $135,000 gain, would that 1% loss of $10,000 in one month really hurt?

Example 2 are my actual numbers since January 1, 2017, but have not taken a loss yet. I am not bragging. Please do not take it that way. Like the Kiplinger article said, you cannot run from stocks. Baby sit your money as I teach here and it will work out.

Have a great weekend.

No comments:

Post a Comment