No new news for me this week as far as retirement.

The S&P 500 is really starting to show us that $2481 is a major barrier. The more times it reaches that level and does not close above it by the end of the day, means that a knee jerk lower is very likely. DMI is negative. Volatility is low which is good, but is not a very reliable indicator. Price is the best indicator. Price need to move in one direction or the other to give us a clue. Right now, all sell warnings are off but we watch that $2481 level closely.

The Small Cap did exactly what I didn’t want it to do. It created a pivot high prior to it climbing above the last all time high. That all time high was the last pivot high. The second bad thing that could happen is that we close below the last pivot low. So that area I drew in purple is important. We need price to reverse, create a pivot low above it and that will show structure of an uptrend. DMI is negative. All we can do at this point is watch and see what happens.

The International made some awesome progress this week. Thurday and Friday price broke through $67.21 closed and stayed above it. The last time this happened it lasted 5 days and fell back through. We are still waiting to get to that 70-71 level from the breakout over a month ago now, so let’s hope this time it sticks. DMI is mixed and volatility is positive. A rip to high side is due.

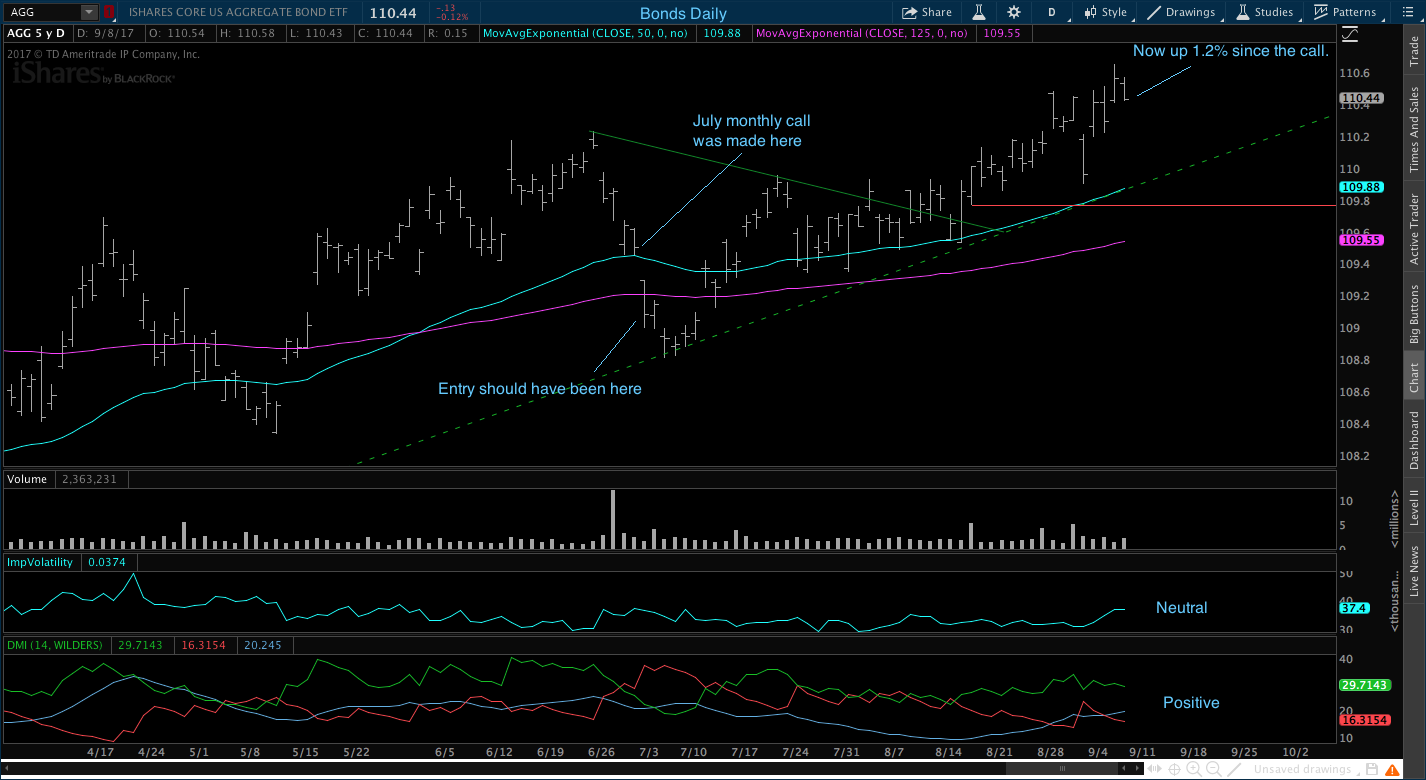

Since the July monthly call to enter Bonds, price has been on steady march bigher. That march has equaled a 1.2% move. Here is what is saying about stocks. When Bonds are moving higher like this, it normally means that the big money investors think that Stocks are to risky. So they are moving their money to safety. It doesn’t always hold true though. Example. Last year at this time, Bonds where up 3.93% and the S&P was up 6.52%. This year bonds are up 2.2%, but the S&P is up 9.94%. So using that old addage might not always be rock solid. The only real take away for me is that I missed an opportunity on the orginal call but I’m still good with my setup. Remember, everything is a monthly buy as of today.

In conclusion: Don’t ignore the monthly calls. The S&P and Small cap are a little shaky at the moment and price for both need to start climbing soon or they will lead us lower.

No comments:

Post a Comment