What a week we had. 1 index ripped higher, 1 formed a bull flag, 1 making all time highs, and 1 fired a buy signal. My TSP account closed Friday at all time highs. Everything is happy and we are making big money. What is there not to like? Well, when things get so rosey that small investors like us start making good money and looking like heros in the stock market, the big money pulls the rug out from underneath of us. Seen it a few times at my age. So I went back to April 2016 to get my % gain since that point because I have been in the C and S continously since that point. I’m up 36.6%. So why am I telling you this? Bragging? Nope! I’ve been running this way because of the monthly moves and if the markets were to tank 5% in one month, I’m still good. The monthly moves would also get me out at or about that point. So, if you have been following along and playing the monthly moves since at least that time, we have a nice buffer built in. No I do not want to give a penny back, but that’s impossible. Eventually the party will end and we will lose a little money and sit out until the monthlys tell us to get back in. But for now, we ride that wave uphill for all it’s worth.

Retirement news: It is final. I submitted my request for a retirement amount back in December 2016. I got my answer about 6-8 weeks later. That estimate was within $4. How awesome is that? I am pleased. I will be able to live on my retirement less all the deductions that I do not have to pay anymore, at almost the same level without withdrawing from TSP. If I took money from my TSP, I could equal or exceed. So from Retirement day, June 30th, it took until October 11th to go through the entire process. 113 days counting weekends to get your final monthly payout with stipend.

Your new CSA page will look like the one above once they have finalized your account. Some other details. Your health insurance is being paid as you move along even though it doesn’t show in the intermin checks. No state tax is being withheld and it still will not be unless you select it with the 3rd item down, first column. You will get back pay for those short Intermin checks, which for me was 3 months worth of back pay. I’ll take it. So now, I just live my life and let the working people do what the working people do. Time for me to sit back and enjoy the fruits of my labors.

Personal news: My mother has been moved into her final home and is really happy. In just one day, has been reunited with a long forgotten friend. Amazing! Praying she will heal and blossom there. My brother and wife knocked it out of the park making her new apartment look like her old home. I was exremely impressed and proud.

Let’s dig into the charts!!!

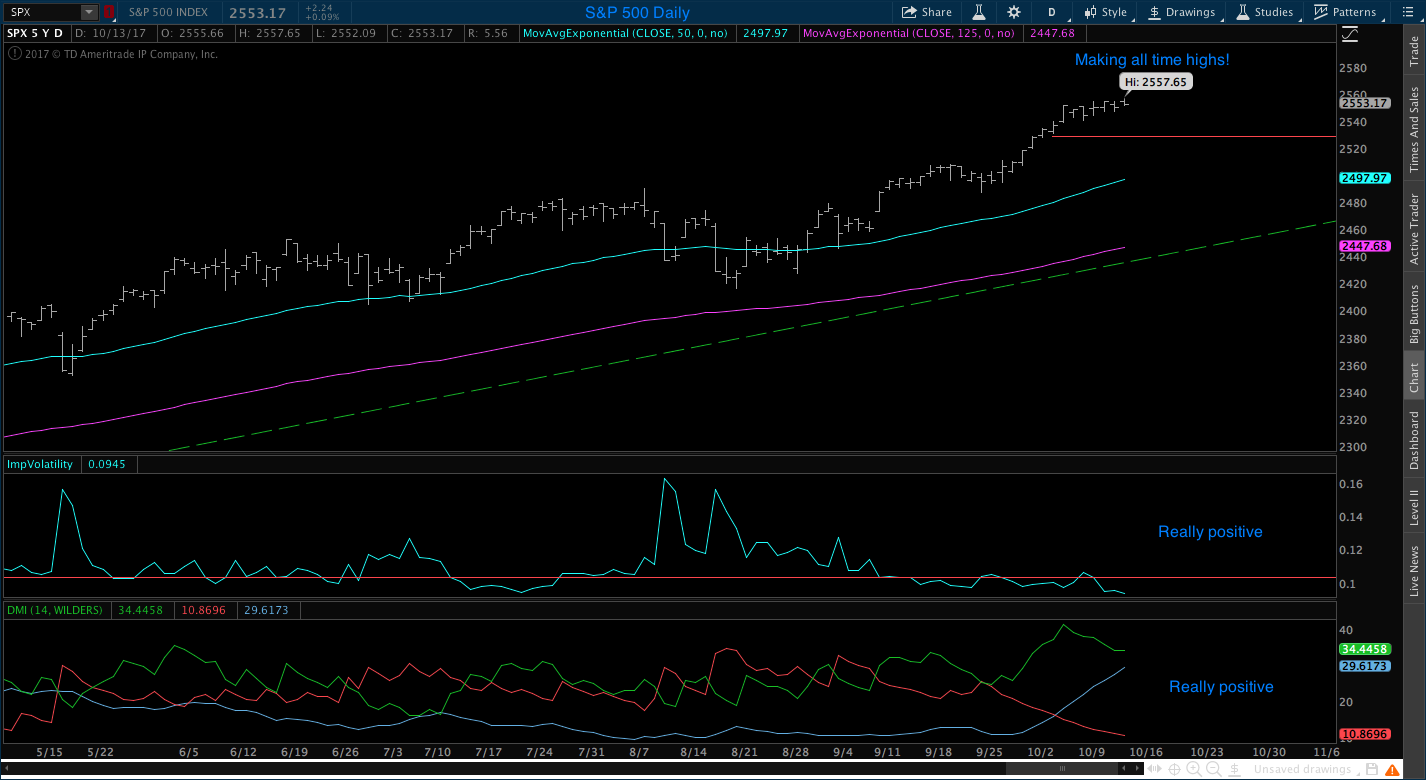

I love the climb angle on the S&P 500. It is a nice slow grind uphill with no drama. The DMI and Volatility are are very positive and indicates that this slow grind will continue. The S&P 500 is also still making all time highs. When will this part end? Well until it does we ride.

The Small cap turned a little lower this week. It also formed a bull flag. That normally means in time, we are heading higher again. These bull flags normally run 10-15 trading days before they break higher. When it breaks, I will post an estimated target. For now, we ride.

This week squarely belonged to the International index. Up 1.57% and help push me to all time highs. Volatility is positive. DMI is positive and is getting ready to go really positive when the blue line crosses above red. Expect a slow down again if we readh $70.79 next week or soon there after. That level is considered overhead resistance and it is also the highest level reached on the International since June of 2014. This will not be all time highs, but a major move if broken through. We continue to ride the I-fund.

Bonds really surprised me this week. I was expecting lower prices and the weekly chart to fire a sell. What we got instead was 5 days in a row with rising prices. Friday we got a larger than normal pop to the high side and it caused the chart to fire a buy signal. That buy signal has to be confirmed Monday. Volatility is low and the DMI looks to be flipping to positive. What happens next week is just a guess, but my gut intention thinks prices will fall. I am not invested here at all, so I will just watch.

Conclusion: What’s not to like in the stock market? This party has to end soon, but until it does I will just enjoy it. Keep working hard and investing toward your retirement but don’t wish your life away. Retirement for those still working will be here in a blink.

No comments:

Post a Comment