It’s been two weeks since I posted any daily charts and you would think by now we would have direction, plus or minus. Well we do not but the daily charts are starting to show some signs, so let’s get to them.

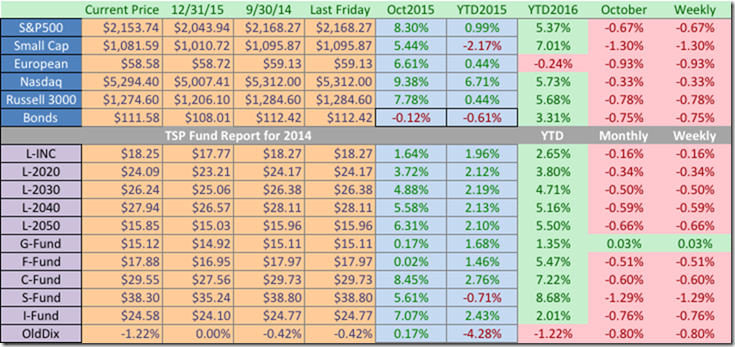

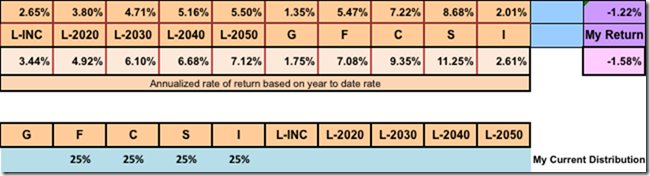

The S&P 500 daily chart has fired, once again, warning 1 and 2. It has done this several times over the last few weeks. We have been grinding so long and accomplishing nothing for so long, you would think we should be trending in a direction by now. If you see the green uptrend line and compare to where price is located today, you can see things are coming together and a move seems to be eminate. What is the chart saying? If I was a beating man based on all signals I would say a break lower is the most likely direction. We have bounced off of overhead resistance several times and can not seem to be able to break through. The DMI index at the bottom of the chart is indicating that lower prices are in the future. It is almost as if the market is just waiting for something bad to happen so it can jerk lower and then the buyers will have an oppourtunity to buy. With all this said, just keep in mind we are looking at charts with past data and trying to understand what it might be trying to tell us. No one knows for sure whether we are going to breakout lower or higher. What I can tell you is that this daily chart is looking tired and weak. Monthly & Weekly we are still ok. I’m once again placing a hold on the C-fund. If your not in the C-fund, that means do not get in, if your in, stay for now.

The Small Cap has no warnings yet but price levels are so close that just a few pennies down could start firing them. Just like the S&P 500, the overhead resistance will just not fall. The DMI index is negative. The green uptrend is at the decision point for some type of breakout. The question is, what is going to happen?

The International has no warnings either but you are going to hear a familiar theme. The overhead resistance will just break. Price levels are very close to warnings. The DMI index turned negative this week. There is a small uptrend happening here but it very shallow. Looking at the chart, it seems the decision point where everything is coming together is still a few weeks off.

Bonds have had a very slow grind lower. It fired and confirmed a daily sell a few weeks back and hasn’t recovered yet. I fired up the old channel in light blue to show you that price is following that channel almost perfectly. Price is now solid below the 50 day moving average and the 50 day is moving lower. The DMI is also negative.

Conclusion: Do you see a common theme here? Overhead resistance has failed so many time on 3 of these indexes a lot. 1 of these Indexes is in a daily sell configuration. The question you and I have to ask is this, are the daily charts giving us a warning that we are about to go much lower? I will say that I’m nervous. I also know that from now until the end of the year is normally the best time to be invested. We normally get our best returns during the next 4 months. I will be watching and riding but with caution.

No comments:

Post a Comment