Ok, I’m going to try something new with the monthly charts to make them easier to read. You only need to know a couple of things. Green on top of blue is buy and blue on top of green is a sell. There will also be a green arrow to confirm the buy signal and you will be able to scan backwards to see when the last one was fired. A red down arrow confirms the sell. As on the far right of the chart you can see the final closing price for the month in green and the final moving average price in blue. Pretty simple, green on top, Buy.

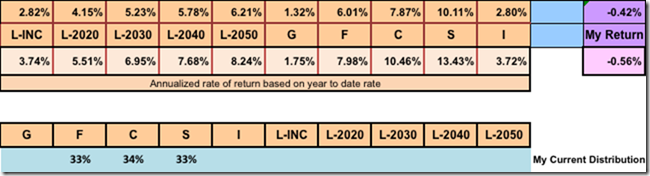

It wasn’t much of a gain for me, but I’ll take it. That is also 7 straight months of gains. September 2015 started my slide last year and I had a 3% loss for the month. September 2016 I squeezed out a .40% gain. That’s actually a big reversal of 2.6%.

The S&P 500 still remains a buy so the C-fund remains a buy. The C-fund actually reported a loss for the month but it was small. No change from last months signal.

The Small Cap remains a buy as of the end of September and no change from last month. S-fund is a buy

The International is still a buy and no change from last month. I love how this chart shows just how early this buy signal is. I-fund is a buy.

Bonds are still a buy and no change from last month. It is also easy to see that Bonds may be starting to fade lower. F-fund is a buy.

If you have an opinion about the new monthly charts, let me know if you love or hate them. Silence means we are good. I will be making no changes to my current setup and will remain equally distributed 25% in each fund.

No comments:

Post a Comment