Hi TSP’ers. I didn’t think I was going to be able to make this weekly chart post, but I made it. The wife and I had 4 days straight of moving and by Saturday afternoon I was mentally and physically beat. That’s not counting the previous month we spent moving things into storage and prepping the house for the move in. I have to hand it to the wife, she worked tirlessly during this move and there were many times I had to just tell her to stop. I really do not derserve her, so sometime in the very near future, I will be taking her to some island on a well deserved vacation. Monday is closing and the money will be in the bank. After that, life will go back to normal on almost every level for us.

Internet service for me is still an issue, but for now I’m using my trusty hotspot. Now to the charts.

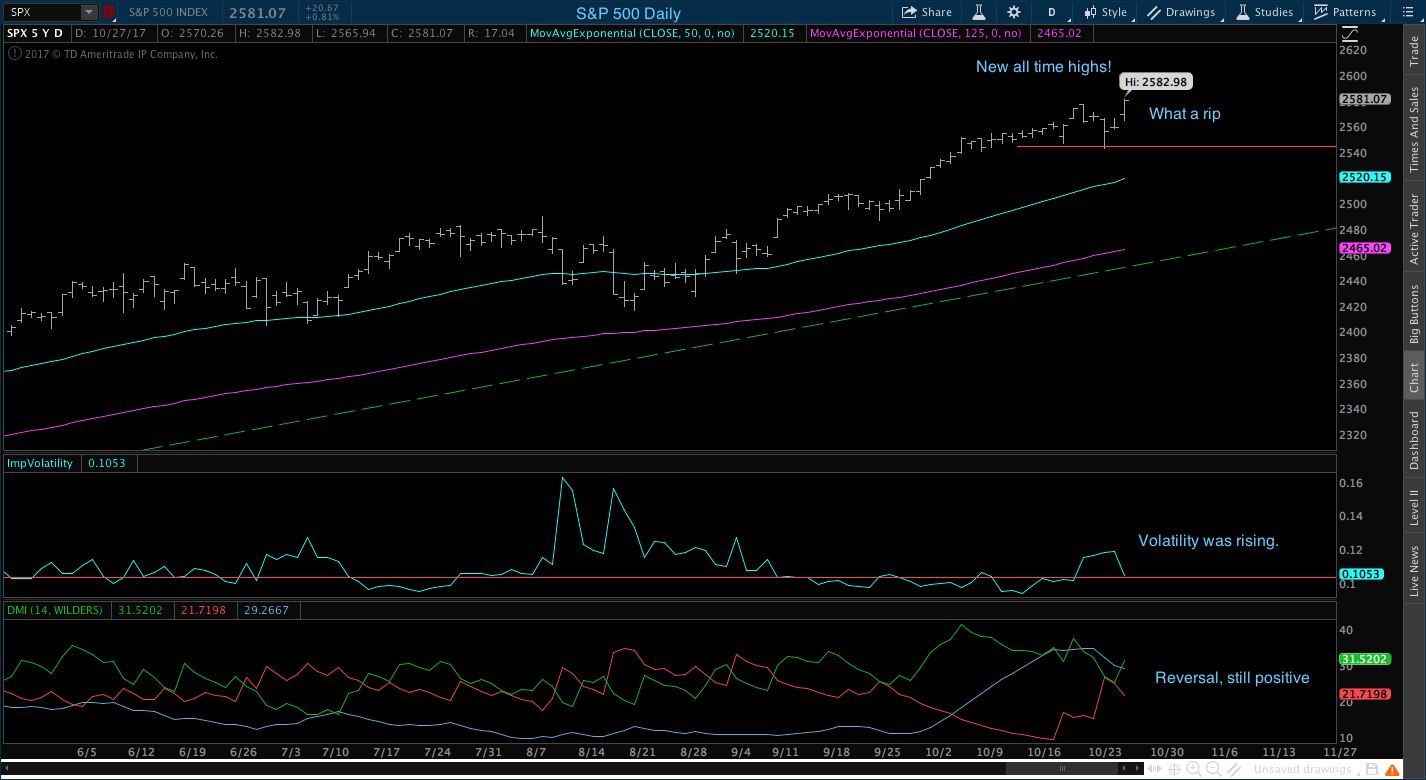

The S&P 500 faded all week long until Friday. Then it exploded to the upside to all time highs. Volatility dropped back down to the positive level. The DMI was looking to turn negative, but then came Friday and snapped back to positive. Nothing to do but ride the wave.

The Small Cap had a nice breakout last week and was suppose to start and uphill run 70 points or so. Well that didn’t happen. Prices faded all week and then recovered Friday to an almost non-event move at a .08 % loss. DMI is looking shaky and good go either way. I still believe we have a good chance for the last Bull Flag breakout to run. We ride.

The International is in a confirmed Bull Flag. Volatility is neutral. DMI is unclear and hard to guess direction. Since we were in an uptrend and now in a Bull Flag, the odds are we breakout to the highside and continue the uptrend. We ride.

Bonds continue the down trend, even though Friday there was a nice pop to the upside. Volatility is positive. DMI is still negative. All signs are that this downtrend continues. The weekly chart would have fired a sell signal Friday if it would not have been for that nice pop to the upside. I will continue to stay out of Bonds.

Conclusion: Monthly moves are coming out Tuesday night, so remember to tune in. Unless something bad happens Monday and Tuesday, we should all end up with a gain for October. As long as we have a .6% gain a month, we should all be happy. Why? That meets are major goal of maintaining a 7% growth for any 12 month period.

I had a conversation with one of my peeps this week that just retired and I asked if they were still invested in the C, S, and I. Their reply was, “no, I wimped out and I’m only invested in the L-Income.” Let me be clear here. There is absoultely nothing wrong with that move and every single professional investor would tell a newly retired individual to stay in the stock market, but the majority should be in safe funds. They are doing exactly as they should. Based on my number research of all past action, show all newly retired peeps should be invested in the L-Income or L-2020. As time passes, these two funds will almost be an exact images of each other because the L-2020 will cease to exist after December 2020. So it becomes more conservative as time marches on. Each investor has their own risk tolerance but the only fund that I do not promote unless the markets are all flagged as monthly sells, is the G-fund. You are outright losing money via inflation and if you are making withdrawals, it’s a double whammy. So do your homework and research the numbers.

For all you working TSP’ers, the maximum amount you can save went up $500 for 2018. So, your new maximum bi-weekly deduction should be $711.53.

No comments:

Post a Comment